Financial Mentoring - 5 Step Financial Empowerment Programme

Who are we and what do we do?

We are team of trained Financial Mentors, working in a not-for-profit organisation, that offer free and confidential financial mentoring to anyone in the community. We can meet with you in our office, over the phone or online.

We understand that talking to someone else about your finances is never easy – and it can make you feel quite overwhelmed or nervous not knowing what to expect. The most important thing we want you to know is that YOU stay in control of the whole process and any decisions are made by YOU.

With the cost of living steadily increasing, many may be feeling unsure on how or where to start with finding a way forward with their finances.

We are keen to help as many people in our community as possible and would love to hear from anyone who needs support.

It may be that your situation is already in a really hard place and you feel that you don’t have any options left. Or it may be that with all expenses increasing you are just starting to feel the strain on your budget and would like a chat to see if there are any suggestions you haven’t considered yet.

Or you might be somewhere in the middle of these circumstances – wherever you are we are happy to help!

How does Financial Mentoring work?

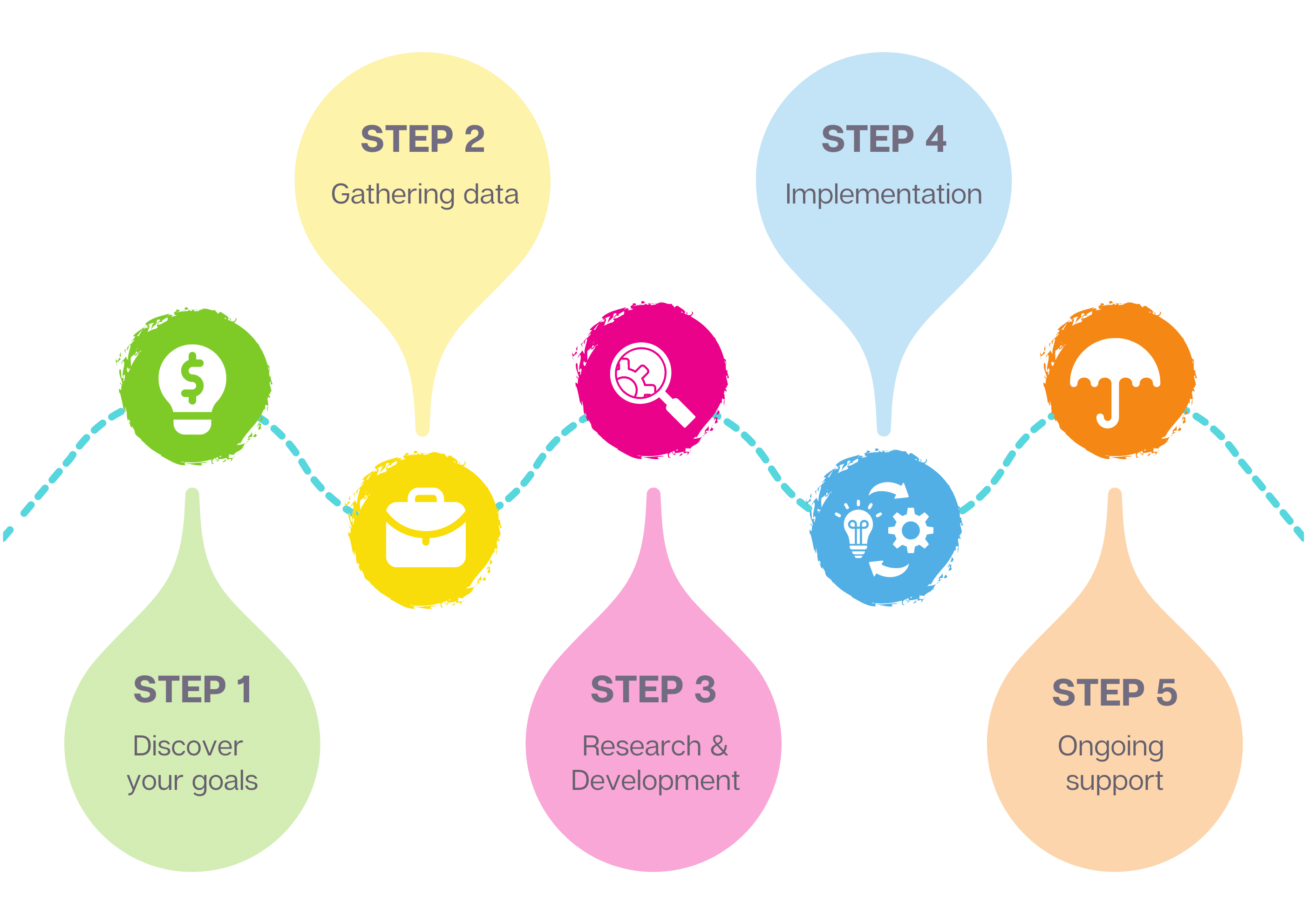

We have a 5-step program to give you support for your Financial Empowerment.

Step 1 – Discover your goals – to understand your individual needs, goals and objectives.

Step 2 – Gathering data to review your current situation.

Step 3 – Research & develop solutions to meet your goals and objectives. Discuss and agree on strategies.

Step 4 – Implementation – supporting you to put the recommendations in place.

Step 5 – Ongoing Support to monitor and evaluate your progress. This is for as long as you want/need.

Our services are completely free, confidential and the entire process is led by you!

If you are curious regarding how we could help you – please get in touch with us to chat or to book an appointment.

What can you expect from meeting with a Financial Mentor:

- When we meet you we will ask you to share as much information as you are comfortable with about your current financial situation – this helps us to assess the type of support you need.

- Most times we will ask you to share your household income & regular expenses so that we can create a budget worksheet with you – this shows us if you have enough money to cover your expenses or not.

- We will offer support and advice to you relating to your specific situation – whether it is a hardship you are experiencing or a goal that you want to achieve.

- We will work with you to help you feel more in control of your budget – this may be by making suggestions on how to reduce your expenses or how to set aside money to cover your infrequent & more significant expenses.

- We can also offer support with communicating with creditors; liaising with Work & Income; applications for Kiwisaver withdrawals or Insolvency options.

When you engage with our service, you can:

- Leave whenever you like.

- Come by yourself or bring the whanau / support person.

- Access support from our service for as long as you feel that you need to – this could be a one-off appointment or ongoing support (short/long term).

For more information on what to expect check out our FAQ page.